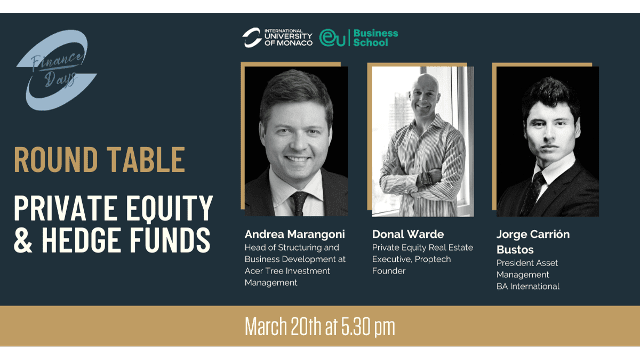

Online Round Table with Alumni "Private Equity & Hedge Funds" - IUM x EUBS

Join our webinar with focus on Finance, more precisely Private Equity & Hedge Funds that will take place Wednesday the 20th of March from 5.30-6.30 pm Monaco time.

This webinar is organised in cooperation with EU Business School and we are delighted that alumni from both schools will be joining this online round table.

Andrea Marangoni is BBA Alumnus from EU Business School in Paris and is working as Head of Structuring and Business Development at Acer Tree Investment Management. Donal Warde graduated with an MS in Finance from the International University of Monaco and is a Private Equity Real Estate Executive and Proptech Founder. Jorge Carrión Bustos graduated with a Bachelor of Science in Finance from EU Business School in Geneva and is currently President Asset Management at BA International.

They will be interviewed by our current MSc in Finance student, Baptiste Faure and will give insights into the Finance industry and their career paths as well as about their experiences with the two schools.

In the final part of the session, all attendees will have the opportunity to ask questions related to the topic.

Please attend the session via this link.

The bios of the participants:

Andrea Marangoni

Andrea is the Head of Structuring and Business Development at Acer Tree Investment Management.

Prior to Acer Tree, Andrea co-founded BirchLane Capital a $350MM credit long / short hedge fund.

From 2009 to mid-2016 Andrea was a trader and member of the Investment Committee at Barclays’ EMEA Special Situations and Distressed Division; Head of Credit Sales for Southern Europe, Switzerland and Austria; part of senior management in EMEA Commodities Division.

Before that, Andrea was at Goldman Sachs in 2000-09 as part of the Hedge Funds Group and Head of Italian Credit Sales; previously at JP Morgan in 1999-2000; Andrea began his career as a proprietary trader at Deutsche Bank in 1996.

Andrea holds a BBA degree from the European University (Nowadays EU Business School), Paris, France.

Donal Warde

Donal Warde's career spans the nexus of real estate and technology, marked by entrepreneurship, leadership in PropTech, and deep expertise in real estate investment. Initially starting as a realtor in France, he quickly ventured into entrepreneurship. Following his Master's in Finance from the International University of Monaco, Warde transitioned to the U.S. to focus on multifamily real estate investments within a private equity setting.

Completing his MBA at Columbia Business School, Warde took on the CEO role at a PropTech company, leveraging computer vision AI to address security challenges in commercial real estate, leading to a successful business exit. His journey includes founding three companies, extensive involvement in institutional real estate investments, real estate sales, and AI model development.

Most recently, he served as an Entrepreneur in Residence at Tenney 110, American Family Insurance's PropTech venture studio, before departing to pursue new opportunities. Fluent in English and French, and currently learning Spanish, Warde is passionate about leveraging technology to enhance living standards.

Jorge Carrión Bustos

Born in Quito-Ecuador; Jorge travelled in 2011 to the UK after graduating from high school to enroll in an advanced English course at EF Cambridge. In 2013 he obtained his Bachelor in Finance from the European University in Geneva - Switzerland (now EU Business School) with the distinction "Cum Laude". In 2015 he obtained a Master of Science in Finance at Business School Lausanne reaching the “Best GPA” Award and passes in 2014 in Zurich the CFA Level 1 Exam.

Jorge’s career path started in Private Equity, in ACE & Company, a global investments boutique based in Geneva where he performed an internship in 2016; later on, in the summer of 2016 he worked at financial planning and analysis for ADM, one of the big four companies at food processing worldwide.

In 2017 Jorge changed industry and worked, as SPOC, for the global leader in Eyecare, Alcon – Novartis.

In 2019, just before the Covid pandemic he moved back to Ecuador and obtained at the end of the pandemic an Associate position at BA International, a private equity firm based in Quito-Ecuador with worldwide investments. After several profitable investments made, in April 2023, he was appointed as President Asset Management.

His average track record for return on investments currently is at 400% or 4X.

Comments0

You don't have the right to access or add a comment. Please log in first.

Suggested Articles